Air operated pinch valves represent a significant investment for industrial facilities, with prices varying dramatically based on size, materials, construction quality, and application requirements. Understanding the pricing landscape helps procurement professionals and engineers make informed decisions that balance initial capital costs against long-term operational expenses. This comprehensive guide examines air operated pinch valve pricing from multiple angles, providing detailed cost breakdowns, comparison frameworks, and strategies to optimize purchasing decisions while ensuring reliable performance.

Price Ranges by Valve Size and Configuration

Air operated pinch valve prices span a wide spectrum depending primarily on nominal size, with costs ranging from a few hundred dollars for small laboratory valves to tens of thousands for large industrial units. Understanding typical price ranges for different size categories provides a foundation for budget planning and vendor negotiations.

| Valve Size | Basic Configuration | Standard Industrial | Premium/Specialty |

| 1/2" - 1" | $200 - $400 | $400 - $800 | $800 - $1,500 |

| 1-1/2" - 2" | $400 - $700 | $700 - $1,300 | $1,300 - $2,500 |

| 3" - 4" | $800 - $1,500 | $1,500 - $3,000 | $3,000 - $5,500 |

| 6" - 8" | $2,000 - $4,000 | $4,000 - $8,000 | $8,000 - $15,000 |

| 10" - 12" | $5,000 - $9,000 | $9,000 - $16,000 | $16,000 - $28,000 |

| 14" - 24" | $12,000 - $20,000 | $20,000 - $40,000 | $40,000 - $75,000+ |

Basic configuration valves typically feature open body designs with natural rubber sleeves, standard pneumatic actuators, and minimal accessories. These entry-level units suit non-critical applications where simple on-off control is required and operating conditions are not severe. While initial costs are attractive, basic configurations may require more frequent maintenance and replacement in demanding environments, potentially increasing long-term ownership costs.

Standard industrial valves represent the most common specification tier, offering enclosed body construction, choice of sleeve materials including nitrile and EPDM, higher pressure ratings, and better quality actuators with position indicators. This mid-range category provides the best value proposition for most industrial applications, balancing upfront investment against reliability and service life. Standard industrial valves typically include one-year warranties and meet common industry certifications.

Premium and specialty configurations incorporate advanced features such as reinforced high-pressure sleeves, exotic elastomer compounds like Viton or Hypalon, sanitary certifications for food and pharmaceutical use, explosion-proof actuators for hazardous areas, or custom materials and dimensions. These high-end units command significant price premiums but prove essential for critical processes, corrosive chemicals, extreme temperatures, or regulatory compliance requirements where failure is not acceptable.

Key Factors Influencing Air Operated Pinch Valve Prices

Multiple variables beyond simple valve size determine final pricing. Understanding these factors enables more accurate cost estimation and reveals opportunities to optimize specifications without compromising performance.

Sleeve Material Selection

The elastomer sleeve represents a substantial portion of total valve cost, with material selection creating price variations of 50-300% for equivalent valve sizes. Natural rubber sleeves offer the lowest cost baseline, typically accounting for 20-30% of total valve price in standard configurations. Upgrading to nitrile rubber for oil resistance adds approximately 15-25% to sleeve cost, while EPDM for chemical resistance increases prices by 20-35% over natural rubber.

Premium elastomers command significantly higher prices due to raw material costs and specialized manufacturing requirements. Viton sleeves, essential for strong acids and solvents, cost 200-300% more than natural rubber equivalents. Polyurethane sleeves for extreme abrasion resistance add 100-150% premium. Food-grade FDA-approved compounds increase costs by 30-60% over industrial grades due to certification requirements and material purity standards. Chemical compatibility should drive material selection, not just price—using inadequate elastomers leads to rapid failure and replacement costs far exceeding initial savings.

Actuator Type and Quality

Pneumatic actuator specifications significantly impact overall valve pricing. Basic single-acting pneumatic cylinders that pinch the sleeve using air pressure and release via spring return represent the most economical option. These simple actuators add $100-500 to valve cost depending on size. Double-acting cylinders that use air pressure for both opening and closing provide more precise control and faster response but increase actuator costs by 40-80% over single-acting designs.

Actuator quality varies widely between manufacturers. Economy actuators from low-cost suppliers may use aluminum bodies, plastic components, and standard seals adequate for clean, dry air service. Premium actuators feature stainless steel construction, corrosion-resistant finishes, high-temperature seals, and precision machining that ensures consistent operation over millions of cycles. The price difference between economy and premium actuators of the same size can reach 150-250%, but premium units deliver superior reliability and longevity in demanding industrial environments.

Valve Body Construction

Open body versus enclosed body designs present substantial cost differences. Open body pinch valves expose the sleeve between two end plates, minimizing material usage and manufacturing complexity. This simple construction reduces costs by 25-40% compared to enclosed designs of equivalent size. However, open body valves offer less sleeve protection and lower pressure ratings, making them suitable primarily for low-pressure abrasive slurry applications where frequent sleeve replacement is anticipated.

Enclosed body valves surround the sleeve with a protective housing, typically manufactured from cast iron, ductile iron, carbon steel, or stainless steel. Housing material dramatically affects price—cast iron bodies represent baseline cost, carbon steel adds 20-30%, and 304 stainless steel increases prices by 80-120% over cast iron. For highly corrosive environments, 316 stainless steel or specialty alloys like Hastelloy can triple body costs compared to standard materials. Body material selection should balance chemical compatibility requirements against budget constraints, considering that the sleeve provides primary fluid contact while the body serves mainly structural and containment functions.

Pressure Rating Requirements

Higher pressure ratings necessitate thicker sleeve walls, reinforcement layers, and stronger body construction, all increasing manufacturing costs. A standard 4-inch valve rated for 60 psi might cost $2,000, while an equivalent size rated for 150 psi could cost $3,500-4,500 due to reinforced sleeve construction and heavier body casting. For applications where elevated pressure is required only occasionally or briefly, specifying pressure ratings closer to actual operating conditions rather than worst-case scenarios can yield significant savings without compromising safety when appropriate safety factors are maintained.

Certifications and Compliance

Industry certifications and regulatory compliance add measurable costs through testing, documentation, and quality assurance processes. FDA certification for food contact applications increases valve prices by 20-40% due to material traceability, cleanroom assembly, and validation testing requirements. ATEX or IECEx certification for hazardous area installation adds 30-60% for explosion-proof actuators and documentation. 3A sanitary certification for dairy processing commands 25-45% premium for specific design features and surface finish requirements. While these certifications increase initial costs substantially, they prove mandatory for regulated industries and cannot be value-engineered away without violating compliance requirements.

Total Cost of Ownership Beyond Purchase Price

Focusing exclusively on initial purchase price often leads to poor economic decisions. Total cost of ownership analysis reveals that operating expenses, maintenance requirements, and replacement costs frequently exceed original valve investment over equipment lifetime.

Sleeve Replacement Costs and Frequency

Replacement sleeves represent the most significant recurring expense for pinch valve operation. Sleeve prices typically range from 30-50% of complete valve cost for standard sizes and materials, meaning a $2,000 valve might require $600-1,000 sleeves. In highly abrasive applications like mine tailings or coal slurry, sleeves may last only 3-6 months, generating annual replacement costs that equal or exceed original valve investment. Over a 10-year operational period, sleeve replacement could cost 5-10 times the initial valve price.

Sleeve longevity varies dramatically based on application severity and material selection. Investing in premium abrasion-resistant polyurethane sleeves that cost 150% more than natural rubber but last 4-5 times longer delivers superior lifetime economics despite higher upfront costs. Similarly, properly sized valves operating at conservative velocities and pressures extend sleeve life substantially compared to undersized valves running at maximum capacity. Total cost modeling should project sleeve life based on similar applications and calculate present value of replacement costs over expected service life.

Energy Consumption and Air Supply Costs

Air operated valves consume compressed air with each actuation cycle, creating ongoing energy costs that accumulate over years of operation. A typical 4-inch air operated pinch valve might consume 15-25 cubic feet of air per complete open-close cycle. In applications cycling 10 times daily, annual air consumption reaches 55,000-90,000 cubic feet. With industrial compressed air costing $0.20-0.40 per thousand cubic feet including generation, treatment, and distribution, annual energy costs range from $11-36 per valve—modest for individual units but potentially significant when multiplied across dozens or hundreds of valves in large facilities.

High-quality actuators with low-friction seals and efficient designs consume 20-30% less air than economy units, recovering their higher initial cost through energy savings over 3-7 years depending on cycling frequency and local air costs. For valves operating in remote locations requiring dedicated air compressors, energy considerations become even more critical as compressor capital costs, maintenance, and electrical consumption must be factored into economic analysis.

Downtime and Maintenance Labor

Production downtime for valve maintenance or failure often represents the largest component of total ownership cost, yet is frequently ignored in purchasing decisions. If a failed pinch valve shuts down a process line generating $10,000 per hour in product value, even a 4-hour emergency replacement creates $40,000 in lost production—far exceeding the cost difference between economy and premium valves. This calculus strongly favors higher-quality valves with longer mean time between failures in critical applications.

Maintenance labor costs vary by valve design accessibility. Open body pinch valves allow sleeve replacement in 15-30 minutes with minimal tools, while some enclosed designs require 2-4 hours for disassembly, sleeve change, and reassembly. At $75-150 per hour for skilled maintenance labor, design differences translate to $100-600 per maintenance event. Multiplied by dozens of sleeve changes over equipment life, easily maintained designs save thousands in labor costs despite potentially higher initial prices.

Spare Parts Inventory Costs

Maintaining adequate spare sleeve inventory ties up working capital and requires storage space. A facility operating 20 mixed-size pinch valves might stock $15,000-30,000 in spare sleeves to ensure rapid replacement capability. This inventory investment, storage costs, and risk of obsolescence or degradation during storage represent hidden ownership costs. Standardizing on fewer valve sizes and sleeve materials reduces required inventory variety, lowering carrying costs while improving parts availability. Some operators negotiate consignment inventory agreements with suppliers who maintain local stock, eliminating inventory investment while ensuring availability.

Comparing Prices Across Manufacturers and Suppliers

Air operated pinch valve markets include global manufacturers, regional specialists, and value-oriented suppliers with varying price positions. Understanding market structure helps identify appropriate vendors for different application criticality levels and budget constraints.

Premium International Brands

Established international manufacturers like Red Valve, AKO, Flowrox, and Trelleborg command premium pricing—typically 30-80% above mid-tier competitors for equivalent specifications. These premium prices reflect extensive engineering resources, rigorous quality control, global technical support networks, comprehensive warranties, and proven track records in demanding applications. For critical processes where failure causes significant losses or safety hazards, premium brand reliability justifies higher costs through reduced failure rates and superior after-sales support.

Premium manufacturers typically offer the broadest product ranges including specialized designs for unique applications, custom engineering services, and most extensive material options. Their technical support assists with proper sizing, material selection, and troubleshooting—valuable services particularly for unfamiliar applications or challenging operating conditions. Premium brand warranties often extend 1-2 years versus 90 days for economy suppliers, providing additional risk mitigation.

Mid-Tier Regional Manufacturers

Regional manufacturers and established secondary brands offer competitive quality at prices 20-40% below premium international suppliers. These companies often specialize in specific industries or applications, developing deep expertise in niche markets. While product ranges may be narrower and global support limited compared to tier-one brands, mid-tier suppliers provide excellent value for standard industrial applications where premium features are unnecessary.

Mid-tier manufacturers frequently offer faster delivery for standard products due to regional manufacturing and distribution, and may provide more flexible customization at lower cost premiums than large multinationals. Their technical support, while less extensive than premium brands, typically proves adequate for conventional applications. Many long-established regional suppliers have installed bases demonstrating decades of reliable performance, indicating quality levels approaching premium brands at substantially lower prices.

Value-Oriented and Import Suppliers

Economy suppliers, many based in Asia, offer air operated pinch valves at prices 40-70% below premium brands. These dramatic savings attract budget-conscious buyers, particularly for non-critical applications or temporary installations. However, value pricing often reflects compromises in material quality, manufacturing precision, quality control rigor, and after-sales support. Economy valves may use lower-grade elastomers prone to premature degradation, actuators with shorter cycle life, and body castings with dimensional inconsistencies affecting performance.

Technical support from value suppliers typically consists of basic sizing charts and installation manuals rather than application engineering assistance. Warranty coverage may be limited to 90 days or exclude wear components like sleeves entirely. Replacement parts availability can prove problematic as economy suppliers enter and exit markets, potentially orphaning installed valves. For non-critical applications with simple operating conditions and where maintenance staff can manage without vendor support, economy valves deliver acceptable performance at minimum cost. Critical applications justify higher-quality suppliers despite increased investment.

Strategies to Optimize Purchasing Costs

Several approaches allow buyers to reduce air operated pinch valve acquisition costs without compromising performance or reliability in their specific applications.

Standardization and Volume Purchasing

Standardizing on fewer valve sizes and configurations across facilities enables volume purchasing discounts of 15-30% compared to small-quantity pricing. When specifying new installations or replacements, defaulting to existing standard sizes—even if slightly oversized for the application—reduces inventory complexity and leverages purchasing power. Many manufacturers offer graduated discounts starting at 5-10 units, with significant breaks at 20, 50, and 100+ unit quantities.

Establishing preferred supplier agreements with one or two manufacturers for annual valve requirements often yields 10-25% price reductions in exchange for committed volume. These agreements also streamline procurement, provide pricing predictability for budgeting, and strengthen relationships that improve technical support and emergency responsiveness. Annual blanket purchase orders with scheduled releases allow buyers to negotiate volume discounts while maintaining inventory flexibility.

Right-Sizing Specifications

Over-specification represents a common source of unnecessary costs. Specifying 150 psi pressure rating when actual service never exceeds 60 psi, or requiring stainless steel bodies for mildly corrosive applications adequately handled by coated carbon steel, wastes capital. Careful review of actual operating conditions versus specified requirements often reveals opportunities to reduce specifications without compromising performance or safety.

Conversely, under-specification to minimize initial cost creates higher total ownership costs through frequent failures and replacements. The optimal approach balances specifications against actual needs with appropriate safety factors—typically 1.25-1.5x for pressure and 1.15-1.3x for temperature. Eliminating unnecessary over-specification while maintaining adequate margins optimizes value.

Timing Purchases Strategically

Valve pricing fluctuates with raw material costs, particularly elastomer compounds derived from petroleum, and stainless steel subject to alloy surcharge volatility. Monitoring market trends and timing large purchases during favorable periods can yield 5-15% savings. End-of-quarter or end-of-year timing may offer additional discounts as suppliers pursue revenue targets. Planning valve requirements 6-12 months ahead enables strategic timing rather than reactive emergency procurement at premium prices.

Balancing strategic purchasing timing against inventory carrying costs requires analysis. For large capital projects installing dozens of valves, early procurement locks in favorable pricing and ensures availability despite potentially higher carrying costs. For routine replacements, maintaining smaller inventories and purchasing as needed may prove more economical despite less pricing leverage.

Considering Remanufactured and Surplus Options

Remanufactured air operated pinch valves from reputable rebuilders offer 40-60% savings versus new units. Quality remanufacturing replaces sleeves, seals, and worn actuator components while inspecting and refurbishing bodies and other structural elements. While not suitable for all applications, remanufactured valves serve excellently in non-critical service or as emergency spares. Establishing relationships with industrial surplus dealers also provides access to new-old-stock valves at discounts when available sizes and specifications align with needs.

- Request quotes from multiple suppliers including different market tiers to establish price ranges and identify best value propositions

- Negotiate total package pricing including spare sleeves, installation accessories, and technical support rather than valve cost alone

- Consider leasing or rental for temporary applications rather than purchasing equipment that will be underutilized

- Evaluate direct manufacturer purchasing versus distributor channels—each offers different advantages in pricing, support, and delivery

Additional Costs Beyond the Valve Itself

Complete project budgeting must account for expenses beyond the valve purchase price that can add 20-60% to total installed costs.

Installation Labor and Materials

Professional installation labor for air operated pinch valves varies by size and complexity. Small valves under 3 inches typically require 2-4 hours of installation time including piping connections and air line hookup, costing $200-600 at standard labor rates. Larger valves from 6-12 inches may need 6-12 hours for proper installation, particularly if heavy rigging equipment is required, generating labor costs of $600-1,800 or more. Installation materials including bolts, gaskets, pipe adapters, air tubing, fittings, and support structures add $50-500 depending on valve size and specific site requirements.

Control and Instrumentation Accessories

Basic air operated pinch valves include only the valve and actuator. Complete functional installations require additional components that significantly impact total costs. Solenoid valves controlling air supply to actuators cost $80-400 depending on size, voltage, and features like explosion-proof construction. Position indicators showing valve open/closed status add $50-200 for mechanical switches, or $200-600 for electronic proximity sensors providing analog position feedback.

Air preparation equipment including filter-regulator-lubricator units ensures clean, properly pressurized air reaches actuators, preventing premature wear. These FRL units cost $100-500 depending on flow capacity and features. Pressure gauges for monitoring air supply pressure add $20-80 each. For automated systems, pneumatic or electronic positioners enabling proportional control rather than simple on-off operation cost $500-2,500 depending on sophistication and communication protocols supported.

Freight and Logistics

Shipping costs for air operated pinch valves range from negligible for small units to substantial for large valves. A 2-inch valve weighing 25 pounds might ship for $25-75 via standard ground freight. An 8-inch valve weighing 200 pounds costs $150-400 for freight depending on distance and service level. Very large 18-24 inch valves weighing 800-2000 pounds require specialized freight handling costing $500-1,500 or more, particularly for expedited delivery or remote locations.

International sourcing introduces additional logistics complexity and costs including customs duties (typically 0-5% for industrial valves), customs broker fees ($100-300 per shipment), and extended transit times. Expedited air freight for emergency replacements can cost 5-10 times standard ocean freight rates. Total logistics costs should be factored into supplier selection, particularly when comparing domestic manufacturers versus distant suppliers offering lower base prices.

Commissioning and Startup

Initial commissioning ensures valves operate correctly and integrates them properly into control systems. Basic commissioning includes air pressure adjustment, stroke verification, and leak testing, requiring 0.5-2 hours per valve. Complex installations with automated control, position feedback, and system integration may need 4-8 hours of commissioning and programming. Some manufacturers offer factory startup services where technicians commission and train operators, costing $800-2,000 per day plus travel expenses—valuable for critical applications or unfamiliar technologies.

Price Comparison with Alternative Valve Technologies

Evaluating air operated pinch valve pricing against alternative valve technologies provides context for value assessment and helps determine when pinch valves represent the most economical solution.

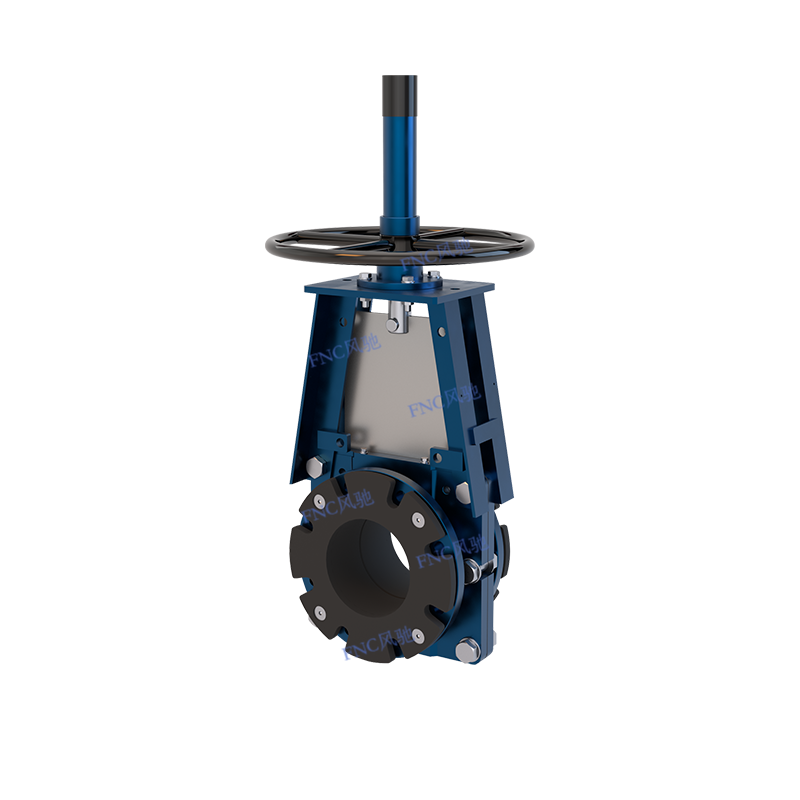

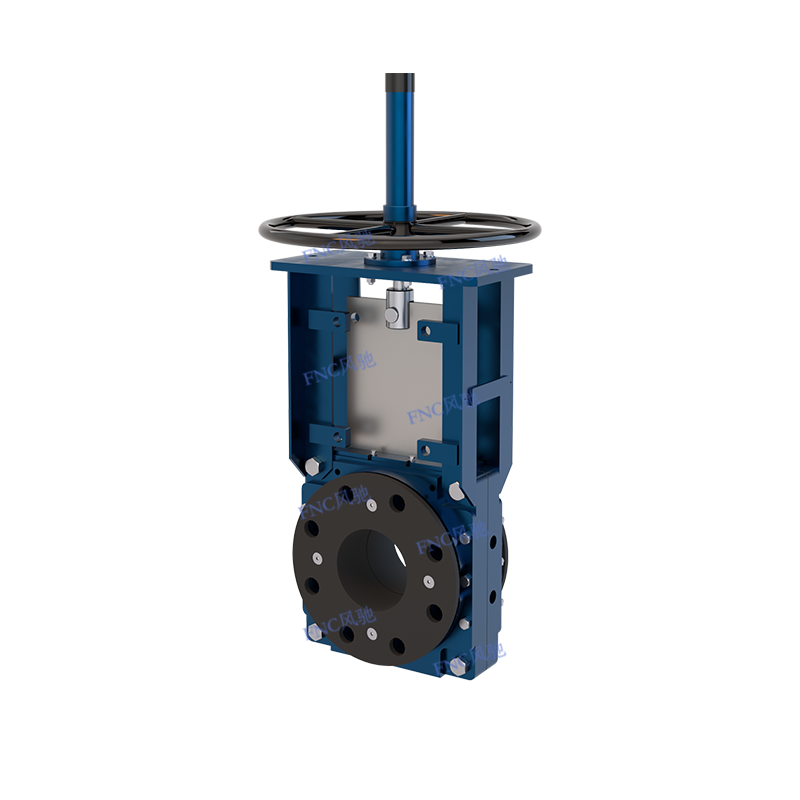

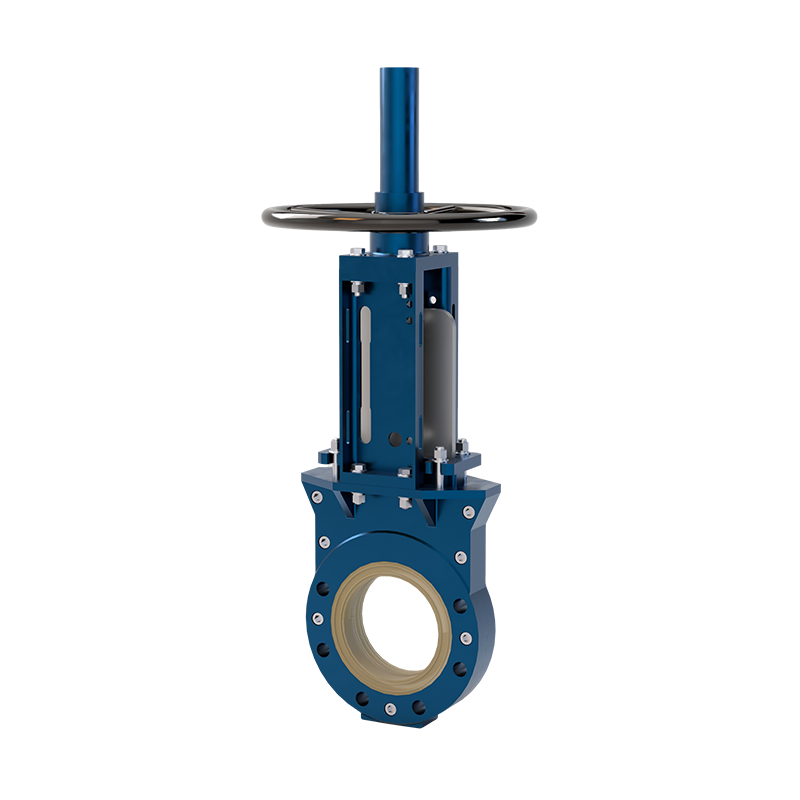

Comparing to ball valves of equivalent size reveals that air operated pinch valves typically cost 10-30% more than automated ball valves for clean water service in common sizes. A 4-inch automated ball valve might cost $1,200-1,800 compared to $1,500-2,400 for an equivalent pinch valve. However, ball valves prove unsuitable for slurries and abrasive materials where pinch valves excel, making direct cost comparison misleading. In abrasive service, ball valve maintenance and replacement costs quickly exceed pinch valve total ownership costs despite lower initial prices.

Knife gate valves represent another common alternative for slurry service. Initial costs for knife gates typically run 20-40% below equivalent air operated pinch valves, making them attractive budget options. However, knife gates require more maintenance due to packing adjustments and blade sharpening or replacement. For highly abrasive applications, pinch valves often deliver lower total ownership costs despite higher upfront investment through reduced maintenance frequency and longer intervals between major component replacements.

Diaphragm valves offer another comparison point, particularly for corrosive chemicals and slurries. Air operated diaphragm valves in smaller sizes (under 3 inches) cost roughly equivalent to pinch valves, while larger sizes typically run 20-50% higher. Diaphragm valves provide excellent chemical resistance but generally cannot handle large solids like pinch valves, limiting applicability. For applications within both valve types' capabilities, selection should weigh total ownership costs including maintenance labor—diaphragm valves typically require more skilled maintenance than pinch valves.

Budgeting for Long-Term Valve Programs

Facilities operating multiple air operated pinch valves benefit from structured long-term budgeting that anticipates replacement cycles, spare parts requirements, and technology upgrades.

Establishing Replacement Reserves

Creating financial reserves for scheduled valve replacements prevents budget disruptions and enables proactive rather than reactive maintenance strategies. Calculate annual reserve requirements by inventorying all installed valves, estimating service life based on operating severity, and dividing total replacement cost by expected years of service. A facility with 30 pinch valves averaging $3,000 each with 8-year average life should budget $11,250 annually for valve replacement reserve.

Sleeve replacement reserves require similar analysis but with shorter intervals. If the same facility's 30 valves require sleeve changes averaging $800 each every 2 years, annual reserve needs reach $12,000. Combined valve and sleeve reserves total $23,250 annually, ensuring funds availability when replacements become necessary without emergency procurement or capital appropriation requests.

Planning for Technology Upgrades

Air operated pinch valve technology evolves continuously with improved elastomer formulations, more efficient actuators, and better monitoring capabilities. Budgeting for periodic technology upgrades rather than simple like-for-like replacement enables facilities to benefit from performance improvements. Allocating 10-20% additional budget beyond basic replacement costs funds upgrades to better materials, higher efficiency actuators, or integrated position sensing that improves control and provides early failure warning.

Technology upgrade planning should align with process improvement initiatives and sustainability goals. Newer high-efficiency actuators reducing air consumption by 25% might add $200-400 to valve cost but generate energy savings recovering the premium within 3-5 years while supporting corporate carbon reduction targets. Upgrading from basic to precision-molded sleeves might increase sleeve costs by 30% while doubling service life, improving long-term economics and reducing maintenance burden.

Multi-Year Purchasing Agreements

Large facilities benefit from multi-year supply agreements that lock in pricing, ensure parts availability, and provide budget predictability. A three-year agreement committing to minimum annual purchases of $50,000-100,000 typically yields 15-25% discounts versus transaction-based purchasing while guaranteeing delivery priority and dedicated technical support. These agreements also facilitate long-term planning as facilities know replacement costs with reasonable certainty, enabling more accurate total ownership cost projections.

Multi-year agreements should include price adjustment mechanisms tied to material cost indices rather than fixed pricing throughout the term. This approach protects suppliers from extreme raw material inflation while providing buyers with transparent, predictable adjustments based on market conditions. Annual true-up reconciliations ensure both parties benefit fairly from the relationship while maintaining pricing that reflects actual costs.

EN

EN

English

English русский

русский Español

Español